Umbrella Insurance Explained: Why The Wealthy Swear By It

When it comes to protecting their assets, the wealthy have access to a range of financial tools and strategies. One of the most popular, yet often overlooked, options among high-net-worth individuals is umbrella insurance. But what exactly is umbrella insurance, and why do the wealthy swear by it? In this article, we’ll explore what umbrella insurance is, how it works, why the wealthy find it indispensable, and whether it’s the right option for you.

Key Takeaways:

- Umbrella insurance offers an extra layer of liability protection above and beyond your primary insurance policies.

- It is especially valuable for high-net-worth individuals who face increased risks of lawsuits.

- The cost of umbrella insurance is relatively low compared to the amount of coverage it provides.

- Umbrella insurance covers a wide range of incidents, including personal injury, property damage, and legal defense costs.

- This coverage is global, meaning it applies to incidents that occur outside of the United States as well.

What is Umbrella Insurance?

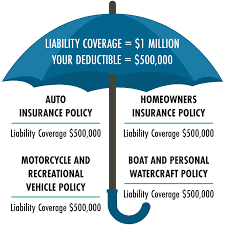

Umbrella insurance is a type of liability insurance that provides an additional layer of protection over and above the limits of your existing insurance policies, such as auto, homeowners, and renters insurance. It is designed to cover claims that exceed the limits of these primary policies, offering protection for legal fees, medical expenses, and damages associated with incidents that involve bodily injury, property damage, or lawsuits.

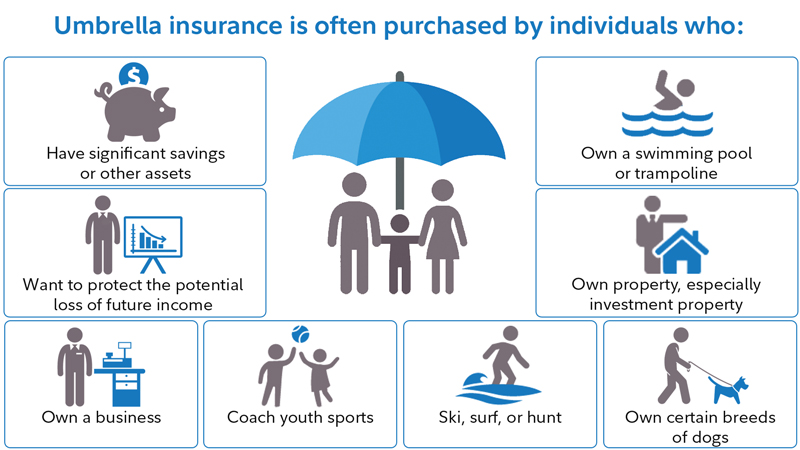

While umbrella insurance is generally associated with wealthy individuals, it is not exclusive to them. Anyone can benefit from umbrella insurance, but it is particularly valuable for those with substantial assets or income to protect. For those with high-net-worth, umbrella insurance acts as a safeguard for their wealth in case of unexpected claims or lawsuits that could potentially put their financial future at risk.

How Does Umbrella Insurance Work?

Umbrella insurance extends your liability coverage once the limits of your primary insurance policies have been exhausted. For example, if you’re involved in a car accident and the damage exceeds the coverage of your auto insurance policy, your umbrella insurance will cover the remaining expenses. Similarly, if someone gets injured on your property and sues for damages, umbrella insurance can cover the lawsuit expenses that surpass your homeowners insurance coverage.

The coverage provided by umbrella insurance typically starts at $1 million, but it can go much higher, depending on the insurer and the specific needs of the policyholder. It is designed to be affordable, and its premiums are relatively low when compared to the coverage it offers, making it an attractive option for those looking to protect their wealth.

Why Do the Wealthy Swear by Umbrella Insurance?

The wealthy understand the importance of protecting their assets, and umbrella insurance plays a pivotal role in this protection. Here are some of the key reasons why umbrella insurance is so highly valued by high-net-worth individuals:

1. Protection Against Lawsuits

One of the main reasons the wealthy swear by umbrella insurance is that they are more likely to be targeted in lawsuits. Individuals with substantial assets, whether in the form of property, savings, or investments, are seen as “deep pockets” by potential plaintiffs. If someone were to file a lawsuit for an accident or injury, the legal costs and damages could quickly exceed the limits of basic insurance policies. Umbrella insurance steps in to cover the additional liability.

For example, a wealthy person involved in a high-profile accident might face a lawsuit that exceeds the $300,000 limit of their auto insurance policy. If they have umbrella insurance with a $5 million limit, the umbrella policy will cover the remaining balance, providing comprehensive protection.

2. Protection for High-Profile Individuals

Celebrities, executives, business owners, and other high-profile individuals are more likely to face lawsuits due to their public visibility or business dealings. For these individuals, umbrella insurance acts as an extra shield against the risk of personal injury claims, defamation lawsuits, or accusations of negligence, especially in situations where they are more likely to be sued because of their wealth and visibility.

In some cases, wealthy individuals may have additional risks that require umbrella insurance, such as owning multiple properties, renting out vacation homes, or operating multiple vehicles. An umbrella policy covers these situations comprehensively, ensuring that their wealth is well protected in the event of an accident or claim.

3. Asset Protection for Families and Business Owners

Umbrella insurance is not only for protecting individual wealth; it’s also vital for safeguarding the financial well-being of families and businesses. For business owners, an umbrella policy can provide coverage for incidents related to their business operations, including legal claims resulting from employee injuries, slip-and-fall accidents on business property, or disputes with customers.

For families, an umbrella policy can ensure that the family home, savings, and investments are shielded from potential legal claims. If a family member is involved in an accident or someone is injured at a family event, the umbrella policy can cover damages or legal expenses that exceed the coverage of other personal liability policies.

4. Affordable Coverage with High Limits

Umbrella insurance is relatively inexpensive compared to the amount of coverage it provides. A basic umbrella policy can cost as little as $150 to $300 per year for $1 million in coverage, making it an attractive option for those who want to protect their assets without paying exorbitant premiums. The cost of the policy increases slightly with higher coverage limits, but it still provides substantial protection at a relatively low cost.

The fact that umbrella insurance offers such high coverage limits at an affordable price makes it an essential component of asset protection for the wealthy. With premiums remaining relatively low, umbrella insurance is a cost-effective way to protect substantial wealth.

5. Worldwide Coverage

Umbrella insurance offers worldwide coverage, which is especially important for individuals who travel frequently or own property abroad. Whether it’s an accident that occurs while on vacation, an incident involving a business trip, or an injury on international property, umbrella insurance can extend beyond the boundaries of the United States to provide legal protection no matter where the incident occurs.

6. Legal Defense Coverage

In addition to providing coverage for settlements or judgments, umbrella insurance also covers legal defense costs. Legal fees can quickly add up when defending against lawsuits, even if the case is frivolous or baseless. With umbrella insurance, legal defense is covered, which can be particularly valuable when dealing with costly and time-consuming litigation.

7. Protection Against Personal Liability

Umbrella insurance is not limited to car accidents or property damage. It also protects against personal liability claims, such as libel, slander, or defamation. High-net-worth individuals who are more likely to be involved in business dealings, media exposure, or public appearances face an increased risk of personal liability claims. Umbrella insurance can cover these situations, ensuring their reputation and financial standing are not threatened by lawsuits.

Also Read :- The Truth About Whole Life Insurance: Pros And Cons

Conclusion

Umbrella insurance is an invaluable tool for protecting your assets and wealth from unforeseen legal claims, lawsuits, and personal liability situations. While it is often associated with high-net-worth individuals, anyone with substantial assets or risks can benefit from this additional layer of protection. Whether you’re protecting your family, business, or personal wealth, umbrella insurance provides a cost-effective way to safeguard against potential financial loss.

FAQs

1. What does umbrella insurance cover?

Umbrella insurance covers a wide range of incidents, including bodily injury, property damage, and personal liability claims that exceed the limits of your underlying insurance policies. It can also cover legal defense costs and certain personal liability situations, such as defamation or slander.

2. How much umbrella insurance do I need?

The amount of umbrella insurance you need depends on your net worth, assets, and lifestyle. A general rule of thumb is to purchase enough coverage to protect all of your assets in the event of a lawsuit. For many high-net-worth individuals, $1 million to $5 million in coverage is typically recommended, but this can vary based on personal circumstances.

3. Is umbrella insurance only for the wealthy?

While umbrella insurance is commonly used by wealthy individuals, it is not exclusive to them. Anyone with significant assets or those who wish to protect themselves from costly lawsuits can benefit from umbrella insurance. It’s an affordable way to add an extra layer of protection to your financial portfolio.

4. Does umbrella insurance cover damage to my own property?

No, umbrella insurance does not cover damage to your own property. It is liability coverage, meaning it helps protect you in situations where you are responsible for damaging someone else’s property or causing injury to another person. Your primary insurance, such as homeowners or auto insurance, would cover your own property damage.

5. How much does umbrella insurance cost?

The cost of umbrella insurance can vary depending on factors such as the amount of coverage you choose, your location, and the number of underlying insurance policies you have. Generally, umbrella insurance is affordable, with annual premiums ranging from $150 to $300 for $1 million in coverage.

6. Does umbrella insurance cover everything?

While umbrella insurance provides broad coverage, it does not cover all situations. For example, it does not cover intentional damage, criminal acts, or damages to your own property. Additionally, umbrella insurance typically doesn’t cover certain types of risks like business-related claims, unless they are specifically included in the policy.

7. How do I get umbrella insurance?

To obtain umbrella insurance, you first need to have primary insurance policies, such as homeowners or auto insurance. Once you have these, you can purchase an umbrella policy through your existing insurer or another insurance provider. It’s important to carefully review the terms of the umbrella policy to ensure it meets your needs.