Top-Rated Business Insurance Providers For Small Businesses

As a small business owner, protecting your company from financial risks is one of the most important steps you can take to ensure long-term success. Whether you run a local retail shop, offer consulting services, or operate an online business, having the right business insurance is essential. But with so many options available, how do you choose the best provider for your business? In this article, we’ll take a deep dive into the top-rated business insurance providers for small businesses, explore the types of coverage they offer, and help you find the best match for your needs.

Key Takeaways:

- Business insurance is crucial for protecting small businesses from financial risk and ensuring business continuity.

- The right provider can offer affordable, customizable coverage tailored to your business’s needs.

- Top providers like Hiscox, The Hartford, Progressive, and State Farm offer specialized options for small businesses.

- Evaluate your business’s needs and risks before choosing an insurance provider.

Why Is Business Insurance Important for Small Businesses?

Business insurance is not just an option — it’s a necessity for protecting your assets, your employees, and your future. Small businesses are particularly vulnerable to a variety of risks, from property damage to lawsuits. Having the right coverage can prevent financial devastation and give you peace of mind knowing that your business is protected.

Here are just a few reasons why business insurance is important:

- Protection from Lawsuits: Small businesses face a higher risk of being sued by customers, employees, or even other businesses. Liability insurance can help protect your company from financial ruin caused by legal disputes.

- Property and Asset Protection: In case of fire, theft, or other disasters, having insurance can cover the cost of repairing or replacing your business property, including equipment, inventory, and buildings.

- Employee Protection: Workers’ compensation insurance helps cover medical expenses and lost wages for employees who are injured on the job.

- Business Continuity: Insurance ensures that your business can continue operating after a disaster or interruption, minimizing financial loss and protecting future revenues.

- Peace of Mind: With the right coverage, you can focus on growing your business without worrying about the “what-ifs.”

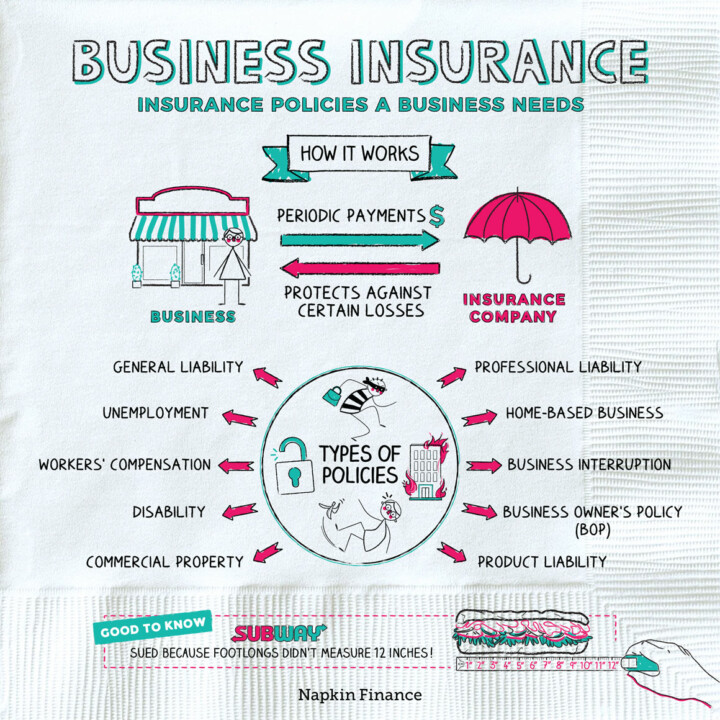

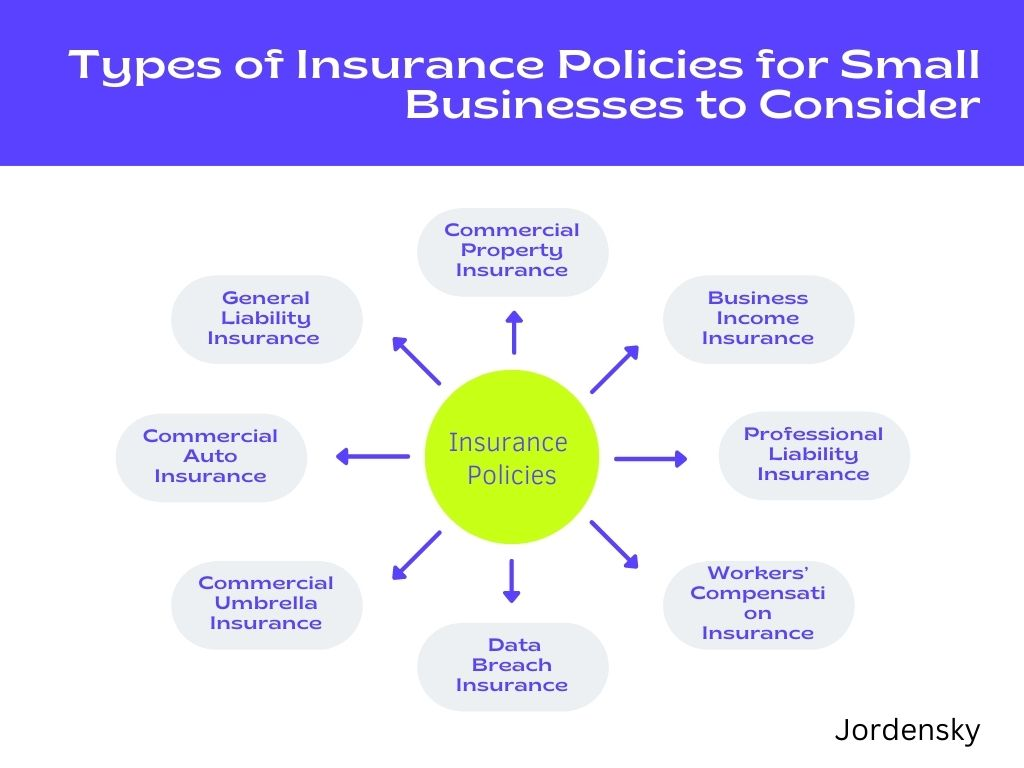

Types of Business Insurance for Small Businesses

Before we explore the top-rated insurance providers, it’s important to understand the types of coverage small businesses may need:

- General Liability Insurance: Covers claims of bodily injury or property damage that occur as a result of your business operations.

- Professional Liability Insurance: Protects businesses that provide professional services from claims of negligence or malpractice.

- Property Insurance: Covers damage to your physical assets, such as buildings, equipment, and inventory.

- Workers’ Compensation Insurance: Provides coverage for medical expenses and lost wages if an employee is injured while on the job.

- Business Interruption Insurance: Helps compensate for lost income and expenses if your business operations are interrupted due to a covered event, such as a natural disaster.

- Commercial Auto Insurance: Covers vehicles used for business purposes in case of accidents, theft, or damage.

- Cyber Liability Insurance: Protects against data breaches, cyberattacks, and other technology-related risks.

Top-Rated Business Insurance Providers for Small Businesses

Now that we understand the importance of business insurance and the types of coverage available, let’s dive into the top-rated insurance providers for small businesses. These companies have earned their reputation by offering comprehensive coverage, exceptional customer service, and affordable pricing options.

1. Hiscox

Overview: Hiscox is one of the leading business insurance providers, particularly for small businesses. With over 100 years of experience, they specialize in offering flexible coverage tailored to the needs of small business owners across various industries.

Key Features:

- Customizable policies for small businesses in fields such as consulting, tech, construction, and healthcare.

- Online quote process for easy access to pricing and coverage options.

- Specialized coverage for niche businesses such as home-based businesses, contractors, and freelancers.

- Excellent customer support with a focus on helping small businesses navigate insurance requirements.

Why It’s Great for Small Businesses:

Hiscox offers affordable, customizable policies that cater to businesses of all sizes and industries. Their online platform makes it easy to obtain quotes and purchase coverage quickly.

2. The Hartford

Overview: The Hartford is a highly respected name in the insurance industry, known for its comprehensive range of small business insurance options. It has been serving businesses for over 200 years and has a reputation for reliability.

Key Features:

- Business Owner’s Policy (BOP) combines general liability and property insurance into one affordable package.

- Workers’ Compensation Insurance with excellent coverage options for employees.

- Cyber Liability Insurance to protect against data breaches and online threats.

- Business Interruption Insurance to cover lost income in case of disaster or unexpected interruptions.

Why It’s Great for Small Businesses:

The Hartford’s BOP combines two essential types of coverage into one, simplifying the process for small business owners. Additionally, their workers’ compensation insurance is tailored to provide the right amount of protection, no matter the industry.

3. Progressive

Overview: Progressive is known for its auto insurance, but they also offer an impressive range of coverage for small businesses. Whether you’re an independent contractor or a larger small business, Progressive has flexible options to suit your needs.

Key Features:

- Commercial Auto Insurance for businesses that use vehicles for deliveries, transportation, or client visits.

- General Liability Insurance for small businesses to cover common risks like slip-and-fall accidents.

- Professional Liability Insurance for those in the service industry.

- Affordable premiums with various discounts available, especially for bundling different types of coverage.

Why It’s Great for Small Businesses:

Progressive’s commercial auto insurance is one of its standout offerings, making it ideal for businesses that rely on transportation. The company also provides customizable coverage packages for different industries.

4. Nationwide

Overview: Nationwide is one of the largest and most well-established insurance providers in the country. They offer a comprehensive suite of business insurance products that can be tailored to meet the needs of small business owners.

Key Features:

- Business Owner’s Policy (BOP) that bundles general liability and property coverage.

- Workers’ Compensation Insurance for employee injuries and accidents.

- Cyber Insurance for protection against data breaches, especially valuable for tech-savvy small businesses.

- Umbrella Insurance to provide additional liability protection beyond the limits of your other policies.

Why It’s Great for Small Businesses:

Nationwide is a top choice for small businesses due to its wide array of insurance products, including coverage for niche industries. Their expertise in both personal and business insurance makes them a reliable choice for small business owners.

5. State Farm

Overview: State Farm is one of the best-known insurance companies in the U.S. They offer a wide range of products for small businesses, including general liability, property insurance, and professional liability coverage.

Key Features:

- Customizable coverage for a variety of industries, including contractors, retailers, and service businesses.

- Strong local agent network for personalized service and consultation.

- Affordable premiums with a variety of bundling options.

- Commercial Auto Insurance for businesses with vehicle fleets or those that rely on transportation.

Why It’s Great for Small Businesses:

State Farm’s strong network of agents offers personalized service, helping small businesses choose the right coverage. Their flexible policies and reasonable pricing make them a popular choice among small business owners.

6. Chubb

Overview: Chubb is known for providing high-quality coverage for businesses that require more comprehensive or specialized insurance. They cater to small businesses with high-value assets or unique needs, such as tech startups, luxury goods retailers, or international operations.

Key Features:

- Comprehensive liability coverage for a wide range of risks.

- Business Interruption Insurance with extensive protection.

- Specialized coverage for technology and international businesses.

- High coverage limits for businesses with substantial assets or specific needs.

Why It’s Great for Small Businesses:

Chubb excels in providing coverage for businesses that require high limits or specialized insurance. They offer tailored policies for unique industries, making them ideal for businesses that need more than just basic coverage.

7. Zenith Insurance

Overview: Zenith Insurance is a lesser-known but highly respected provider of workers’ compensation insurance. It focuses on offering workers’ compensation coverage to small businesses across various industries.

Key Features:

- Workers’ Compensation Insurance for businesses of all sizes.

- Industry-specific coverage tailored to the needs of sectors such as healthcare, retail, and manufacturing.

- Strong customer support with a focus on helping businesses manage employee-related risks.

Why It’s Great for Small Businesses:

Zenith Insurance is an excellent choice for small businesses that need reliable workers’ compensation insurance. Its customer support and industry-specific expertise set it apart from other providers.

Also Read :- Is Travel Insurance Necessary? Hidden Benefits Explained

Conclusion

Choosing the right business insurance provider is critical to safeguarding your company’s future. Each of the top-rated providers mentioned above offers excellent coverage options that cater to small businesses. The best insurance provider for your business will depend on factors such as your industry, budget, and the specific risks your company faces.

Whether you’re looking for comprehensive coverage, specialized policies, or excellent customer service, these providers offer reliable and customizable insurance solutions that can give you peace of mind while protecting your business assets.

FAQs

1. What type of business insurance do I need?

The type of insurance you need depends on your business size, industry, and risks. Common types include general liability, property insurance, workers’ compensation, and professional liability insurance.

2. How much does business insurance cost?

Business insurance costs vary depending on factors such as the size of your business, industry, location, and coverage needs. On average, small businesses may pay between $400 to $2,000 annually for general liability insurance.

3. Can I purchase insurance for a home-based business?

Yes, many insurance providers offer coverage specifically for home-based businesses. You can often add coverage to your existing homeowner’s policy or purchase a standalone business policy.

4. Is business interruption insurance necessary?

If your business could be impacted by disasters or unexpected events, business interruption insurance is important. It can provide coverage for lost income and expenses during disruptions.

5. How can I reduce my business insurance premiums?

You can lower premiums by bundling policies, maintaining a good claims history, implementing safety measures, and choosing higher deductibles. Consult with your insurance provider for specific tips based on your business.

6. Do I need workers’ compensation insurance for my small business?

If you have employees, most states require you to have workers’ compensation insurance. This coverage helps pay for medical costs and lost wages if an employee is injured on the job.

7. Can I change my business insurance policy after I’ve purchased it?

Yes, you can typically make changes to your policy, such as increasing coverage or adding new coverage types. Contact your provider to discuss adjustments to your policy.