Is Travel Insurance Necessary? Hidden Benefits Explained

Traveling is one of life’s most exciting experiences, offering opportunities for adventure, relaxation, and exploration. However, it also comes with inherent risks — from flight cancellations to medical emergencies. This is where travel insurance comes into play, providing peace of mind and protecting travelers from the unexpected. But is travel insurance really necessary, or is it just an added expense that’s easy to skip? In this article, we will delve into the hidden benefits of travel insurance, why it’s important, and how it can safeguard your trip, your health, and your finances. By the end, you’ll have a clear understanding of whether travel insurance is something you should consider for your next journey.

Key Takeaways:

- Travel insurance offers protection against unexpected events, including trip cancellations, medical emergencies, and lost luggage.

- It is especially important for international travel, covering expenses not included in regular health insurance.

- Travel insurance can also cover additional expenses such as trip delays, emergency evacuations, and repatriation.

- The hidden benefits of travel insurance include peace of mind, 24/7 assistance, and protection against the financial risks of unpredictable events.

What is Travel Insurance?

Travel insurance is a type of coverage designed to protect travelers from unforeseen circumstances that could interfere with their trips. It typically covers a wide range of events, such as trip cancellations, interruptions, lost luggage, travel delays, medical emergencies, and other emergencies while traveling.

Travel insurance can be purchased for individual trips or as an annual multi-trip policy, depending on your travel habits. It offers financial protection in case of situations that are beyond your control, such as flight cancellations due to bad weather or a sudden medical emergency while abroad.

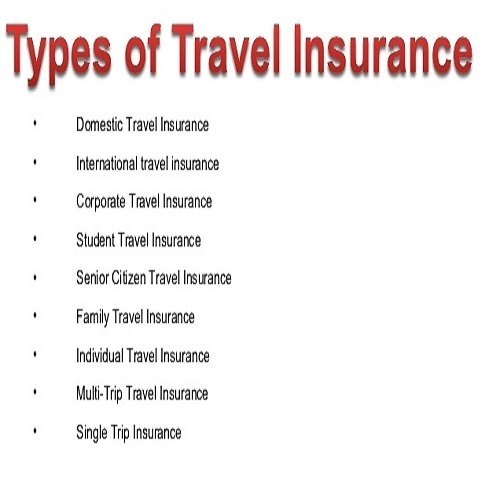

Types of Travel Insurance

There are several types of travel insurance policies available, each offering a different level of coverage. The main types include:

- Trip Cancellation Insurance: Covers non-refundable travel expenses if you need to cancel your trip due to illness, family emergencies, or other covered reasons.

- Trip Interruption Insurance: Covers the costs incurred if you need to cut your trip short due to a covered event.

- Medical Insurance: Covers medical expenses if you become ill or injured while traveling, especially important when traveling abroad, where domestic health insurance may not apply.

- Baggage Insurance: Covers lost, damaged, or stolen luggage and personal belongings during your trip.

- Emergency Evacuation Insurance: Covers the cost of transportation to a medical facility if you need emergency evacuation due to illness or injury.

- Travel Delay Insurance: Provides compensation for expenses incurred if your travel is delayed for a specific period due to factors such as weather or mechanical failures.

Each of these options provides critical protection, ensuring that you don’t bear the full financial burden of unexpected events that can happen while traveling.

Why is Travel Insurance Necessary?

Travel insurance may seem like an unnecessary expense for some, but in reality, it can be a lifesaver in times of crisis. Whether you’re embarking on a business trip, a family vacation, or a solo backpacking adventure, travel insurance provides a layer of security against potential disruptions. Here are several key reasons why travel insurance is necessary:

1. Protection Against Unexpected Trip Cancellations

One of the most common reasons people purchase travel insurance is to protect themselves from the financial fallout of a trip cancellation. Whether you’re canceling a trip due to an illness, a death in the family, or an unavoidable work conflict, non-refundable travel expenses such as flights, hotels, and tours can add up quickly. Trip cancellation insurance ensures that you can recover some or all of your prepaid expenses if you have to cancel for a covered reason.

For example, if you’ve paid for a cruise that requires you to cancel because of a medical emergency, travel insurance can help you recoup the non-refundable costs.

2. Medical Emergency Coverage Abroad

When traveling internationally, one of the most significant concerns is health care. Many travelers assume that their domestic health insurance will cover them abroad, but this is not always the case. Travel insurance provides essential medical coverage for emergency treatments, surgeries, and hospital stays, especially when you’re in a country where your regular health insurance doesn’t offer coverage.

If you become ill or injured while traveling, travel insurance can ensure that you receive the medical attention you need without worrying about astronomical medical bills. It can also cover evacuation costs to bring you back to your home country if the treatment you need is unavailable locally.

3. Lost, Stolen, or Delayed Baggage Protection

Baggage issues are a common problem for travelers, especially when flying with multiple layovers or with unreliable airlines. Travel insurance provides coverage for lost, damaged, or stolen luggage, as well as for expenses incurred if your baggage is delayed for a long period.

If your luggage is lost or delayed, travel insurance can reimburse you for essential items such as clothing, toiletries, and medications that you may need until your luggage is returned. For example, if you’re traveling to a remote location and your baggage is delayed for a couple of days, travel insurance can help you purchase essential items to ensure your comfort until you get your belongings.

4. Protection Against Travel Delays and Missed Connections

Flight delays or missed connections can happen due to a variety of reasons, from bad weather to mechanical issues. In these situations, travelers can be stuck with additional expenses like accommodation, meals, and transportation. Travel insurance covers these additional costs, making your travel experience less stressful.

For instance, if your flight is delayed for more than six hours, you may be entitled to reimbursement for meals, accommodations, or transportation to get to your next destination.

5. Emergency Evacuation and Repatriation

Emergencies can arise unexpectedly while traveling, from natural disasters to political unrest. If a situation arises where you need to be evacuated for your safety, travel insurance will cover the cost of getting you out of harm’s way.

In the event of a serious illness or injury, travel insurance also covers the cost of repatriation, which is the process of returning you to your home country for medical treatment. This is especially important if you are traveling to remote or less developed areas where medical care may not meet your needs.

6. Peace of Mind

Travel insurance gives you peace of mind, knowing that no matter what happens, you have a safety net in place. The potential for an unexpected emergency or event that disrupts your trip is always present, but with travel insurance, you can minimize the financial burden and emotional stress. It allows you to focus on enjoying your trip rather than worrying about worst-case scenarios.

7. Additional Travel-Related Benefits

Some travel insurance policies offer bonus coverage for situations that aren’t covered by typical travel protections. For example, they might cover things like rental car damage, trip interruptions, or emergency family reunions. Some policies even offer concierge services or 24/7 emergency assistance, which can be a game-changer if you need help finding medical care or navigating a foreign country during an emergency.

Also Read :- Umbrella Insurance Explained: Why The Wealthy Swear By It

Conclusion

While travel insurance is an additional cost that some may overlook, it can provide invaluable protection when unexpected situations arise. From cancellations and medical emergencies to lost luggage and trip interruptions, travel insurance ensures you won’t be left stranded financially in case something goes wrong. Whether you’re planning a luxury vacation, a family trip, or a business excursion, having travel insurance can give you the peace of mind to enjoy your journey without unnecessary stress.

FAQs

1. Do I need travel insurance for every trip?

Not necessarily. If you are traveling for a short period and to a nearby destination, travel insurance may not be necessary. However, if you’re traveling internationally, engaging in risky activities (like skiing), or have expensive, non-refundable plans, travel insurance can provide essential protection.

2. What’s the difference between trip cancellation and trip interruption insurance?

Trip cancellation insurance covers the cost of your trip if you have to cancel before you leave due to covered reasons. Trip interruption insurance, on the other hand, covers the costs if your trip is cut short while you are already traveling due to a covered event, such as a family emergency or illness.

3. Does my regular health insurance cover me while traveling?

Most domestic health insurance policies do not provide full coverage for international travel. Travel insurance includes medical coverage abroad, which is particularly useful in countries where healthcare is expensive or where your regular health insurance may not apply.

4. Can I cancel travel insurance if I change my mind?

Yes, many travel insurance policies have a “free look” period, which allows you to cancel your policy for a full refund within a specific number of days after purchasing it (usually 10 to 14 days). However, this may not apply if you’ve already made a claim.

5. What if I miss a flight due to a delay?

If a delay causes you to miss your connecting flight or results in additional accommodation costs, travel insurance can reimburse you for the extra expenses, such as meals, hotels, and transportation.

6. Can I get reimbursed for non-refundable costs if I get sick before my trip?

Yes, if you need to cancel your trip due to illness and have purchased trip cancellation insurance, you should be able to recover non-refundable costs, as long as the illness is covered under your policy.

7. Are there any exclusions in travel insurance?

Yes, like any insurance, travel insurance has exclusions. Common exclusions include pre-existing medical conditions, travel disruptions caused by war or political unrest, and claims related to high-risk activities such as skydiving or bungee jumping unless specifically covered by the policy.